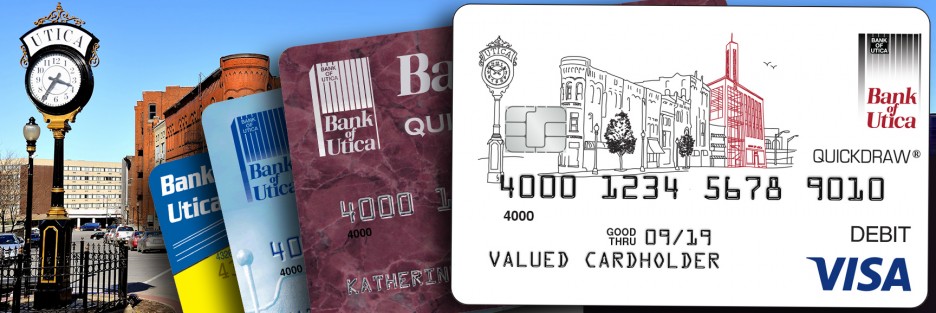

QuickDraw® Visa Debit Card

It's the better way to make all of your everyday purchases. Our FREE QuickDraw® Debit Card allows you to make purchases wherever VISA cards are accepted offering you control, security and convenience -- you may never write another check again!

Convenient and Secure

- Speed through checkout lanes or pay your monthly bills over the phone or online with your Bank of Utica QuickDraw® Debit Card.

- The amount of your purchase is deducted automatically from your checking account, and you can get cash back when you make a purchase or use your card at ATMs easily and securely without paying a Bank of Utica fee*

- Make surcharge-free cash withdrawals at over 55,000 ATMs in the US and select countries with the Allpoint Network of ATMs.

- Your QuickDraw® VISA Debit Card also gives you access to the balance in your account plus your available check credit (a line of credit giving you additional purchasing power) making this a great alternative to high-rate credit cards.

- Real-time fraud monitoring - If a debit card transaction is out of character from your normal spending habits, we may contact you to make sure it's actually yours.

- Zero-Liability Protection - You won't pay for any unauthorized debit card transaction when you notify us promptly**

You will receive a replacement card when your existing card nears its expiration date. It will be the same card number and have the same PIN. Once activated, securely dispose of the old card.

For Card Activation and PIN Services, call 1-800-992-3808.

Daily Limits

$1,000 for cash-back transactions

$5,000 of your available balance for purchases

Security

Your QuickDraw® Debit Card can be used in other countries however; there are many countries that are blocked due to significant fraud. If you are traveling overseas, call our Checking Account Department at (315) 797-2761 for more information.

| Notify us immediately if your ATM card or PIN is lost or stolen, or if you believe that someone has withdrawn or transferred money from your account without your permission. You can call our Checking Account Department during business hours at (315) 797-2761 or toll free at (800) 442-1028. At any time, 24 hours a day, even when the bank is closed, you can report your card missing at (800) 472-3272. |

*Other banks may impose a fee which we, unfortunately, have no control over.

**To find out more, review our Electronic Funds Transfer and Quickdraw® VISA Debit disclosure.

Back to Electronic Banking for Personal Banking